|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Understanding Chapter 13 Bankruptcy Credit Card Debt Relief

Chapter 13 bankruptcy can be a lifeline for individuals struggling with overwhelming credit card debt. This legal process allows debtors to restructure their debts and create a repayment plan, providing a path to financial recovery.

What is Chapter 13 Bankruptcy?

Chapter 13 bankruptcy is a type of bankruptcy that allows individuals to repay all or part of their debts under the supervision of the court. It is often referred to as a 'wage earner's plan' and is available to individuals with a regular income.

Benefits of Chapter 13 Bankruptcy

- Debt Consolidation: All your debts are consolidated into one monthly payment.

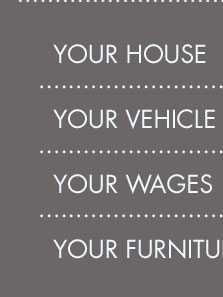

- Property Protection: You can keep your property, including your home and car.

- Interest Rate Reduction: Interest rates on unsecured debt may be reduced.

For those seeking personalized legal advice, consulting bankruptcy attorneys in Riverside County can be a prudent step.

How Does Chapter 13 Handle Credit Card Debt?

Under Chapter 13, credit card debt is categorized as unsecured debt. This means that while it is included in the repayment plan, it does not have priority over secured debts like a mortgage or car loan.

Repayment Plan Structure

- Assessment: The debtor's financial situation is assessed to determine disposable income.

- Plan Proposal: A plan is proposed to repay debts over three to five years.

- Court Approval: The court must approve the proposed repayment plan.

Debtors make monthly payments to a court-appointed trustee, who then distributes the funds to creditors.

Alternatives to Chapter 13 Bankruptcy

While Chapter 13 offers many benefits, it is not the only option for managing credit card debt. Alternatives include debt settlement, credit counseling, and Chapter 7 bankruptcy.

Comparing Alternatives

- Debt Settlement: Negotiating with creditors to pay less than the full amount owed.

- Credit Counseling: Working with a credit counselor to create a debt management plan.

- Chapter 7 Bankruptcy: Liquidating non-exempt assets to pay off debts, potentially discharging most unsecured debts.

Individuals should consider consulting bankruptcy attorneys near my location to explore all available options.

FAQ Section

What happens to my credit card debt in Chapter 13 bankruptcy?

Credit card debt is included in the repayment plan, and you will make monthly payments towards it based on your disposable income.

Can I keep my credit cards after filing for Chapter 13?

Generally, credit card accounts are closed upon filing, and it may be challenging to obtain new credit during the repayment period.

How long does a Chapter 13 bankruptcy stay on my credit report?

A Chapter 13 bankruptcy remains on your credit report for seven years from the filing date.

Credit card debts are general unsecured debts. General unsecured debts are at the bottom of the barrel; how much they get paid depends upon a number of factors, ...

Is It Possible to Qualify for Consumer Debt While in a Pending Chapter 13? ... Yes. Credit cards, vehicle loans, and even residential mortgage ...

As a result, most Chapter 13 plans do not have to provide for the repayment of unsecured debts. The only instance when Chapter 13 plans must provide for payment ...

![]()